The wide hall of the 1980’s mall is lit with artificial light and a line of people are standing outside the sliding glass doors, in front of a velvet rope barrier.

Once inside the bank, we wait patiently for the line to progress and as my mother steps up to the teller, us kids head over to the bank slips. We’re allowed to play with one slip apiece, using a pen that’s affixed to a chain.

This isn’t an article about banking, but this vivid memory of mine seems to ring familiar. It’s a good reminder of how far the banking industry has evolved to remove inconvenience.

In fact, banking is a useful analogy to understand the opportunity to be realized from a better telecom customer experience.

Customer experience evolution to remove the inconvenience

Until very recently, service delivery for Wi-Fi and broadband has followed a traditional call and install model, with troubleshooting calls also relying on a truck roll.

But that paradigm is changing – rapidly.

“And finally, what I have seen a lot about is our innovation to do the self-install, which customers has done by themselves. We learn every time how we do our protocols much better. So, I'm not only hopeful, I'm positive on -- that the whole self-install and totally different way of thinking, getting home broadband, I think it's just right in the timing of the market right now.”

Hans Vestberg - Verizon Communications Inc. - Chairman & CEO J.P. Morgan Global Technology, Media and Communications Conference

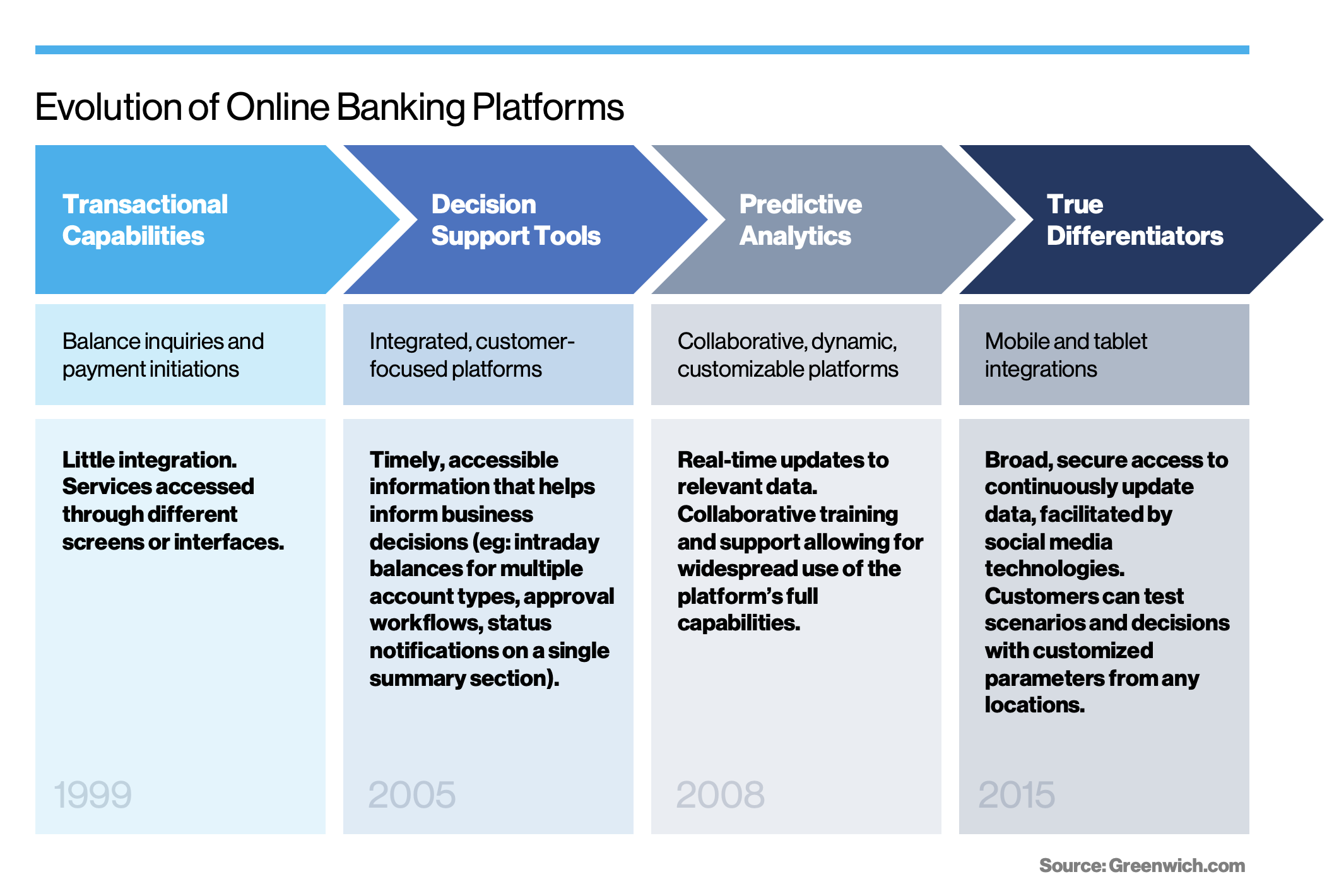

Self-installation is a great first step for telecoms. Like early online banking, it’s largely transactional and straight forward, at the most basic level, making it convenient for self-serve installation and care.

Tips to improve self-installation routines:

- Empower the subscriber to complete a site-survey (This is a good recommendation whether it is self-serve, hybrid or full-serve installation)

- Use an application to determine ideal placement of devices for best service experience

- Enhance self-installation steps using an app and workflow with text, images, videos and links to knowledge base or FAQ that are relevant to the step

- Post install, provide information and contextual data to improve their service

An integrated customer experience that informs decision support and predictive analytics

Account notifications, approval workflows and a transparent, 360-degree view of service delivery. I could be referring to banking or telecom services.

The next era of customer experience seamlessly integrates sales, help-desk and technicians into the subscriber’s journey. If the consumer’s goal is to ‘install my Wi-Fi or fix my video’, a service provider’s customer-facing platform should empower the subscriber to get the job done with smart, contextual information to guide decisions.

The key is not abandoning the subscriber at any point on their journey, and having all data flow through to the next step.

Speaking of journey, higher customer satisfaction and fully enabled self-service will be a goal we evolve into as the market and technology is ready.

In much the same way market demand shifted at the onset of COVID-19, mobile banking adoption was super-charged with the widespread use of smartphones and availability of an app marketplace. Fun fact: Apple app store was launched in July of 2008 with just 500 apps.

Tips to improve customer-guided self-serve and hybrid services:

- Use workflows to integrate verification tests (connectivity, speed test, noise on local loop) or self-healing actions (reboot or upgrade STB firmware)

- The result from a test could be used as in a step in the installation or repair workflow or run behind the scenes to ensure quality of service with self-healing actions

- Use voice, chat, text message, video with camera access to get ‘eyes inside the home’

Understanding the opportunity isn’t 100% automation and self-service

Mobile banking doesn’t support all personal or business banking decisions, even with the today’s robust AI.

In telecommunications, like banking, the objective isn’t to remove the human in all instances. A better objective is using new data and new technology to scale or uncover opportunities.

Differentiation

In banking, contactless payments, voice payments and even invisible payments like Uber are redefining the experience so that users no longer worry about payment, receipts, tips and change.

Optimization

Digital interactions and proliferation of deeper data creates opportunities. The multi-faceted insights generated from this new customer experience will allow further evolution and automation.

New experiences at scale

A lot can happen when you mask the complexity and reduce frustration. As service providers have already witnessed by way of on-demand content - continuous innovation empowers consumers in new ways.

So how has this opportunity been realized in banking?

A significant example is the industry’s capacity for global payments.

Now a trillion-dollar market with double-digit gains YOY; banks are delivering impressive margins at scale despite shifting dynamics. The industry can react to lower per-transaction payment fees and low-interest rate environments because the underlying fundamentals are solid – higher overall number of transactions and electronification. Source: McKinsey & Company

Another example is customer satisfaction with the experience.

88 percent of banking customers says service has improved through technology. For Millennials, this number is 98 percent. Source: Canadian Banking Association

It’s inevitable this shift will also happen in telecommunications. Circling back to the comment from Verizon CEO, Hans Vestberg, “I think it's just right in the timing of the market right now.”

Technology availability, a desire for efficiencies, customer readiness, and market timing have converged.

The next question isn’t if or when, but rather, how and who to partner with to make it a reality.